'Game-changing' New Treatment for NHS Lymphoma Patients

Cancer patients in England will receive a new game-changing therapy treatment under the first negotiated deal of its kind struck in Europe.

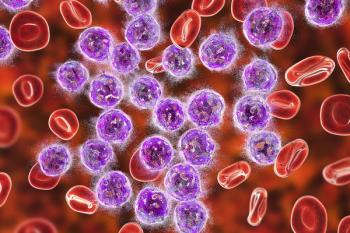

In August, the European Commission approved the chimeric antigen receptor (CAR) T-cell therapy tisagenlecleucel for treatment of pediatric and young adult relapsed or refractory B-cell acute lymphoblastic leukemia (ALL) and for adults with relapsed or refractory diffuse large B-cell lymphoma (DLBCL).

Shortly after these approvals, the United Kingdom’s National Institute for Health and Care Excellence (NICE) issued draft guidance's recommending against use of CAR T-cell therapies axicabtagene ciloleucel and tisagenlecleucel for treating adults with DLBCL after two or more systemic therapies.

Raj Chopra, PhD, head of cancer therapeutics at The Institute of Cancer Research, United Kingdom, said that although these decisions were slightly disappointing, they were not altogether surprising.

“This recommendation was based on two things, a lack of data, as well as the pricing,” Chopra told Cancer Network.

However, by recently striking a deal on cost with Gilead, adult cancer patients with DLBCL in England will be the first adults to have access to CAR T-cell therapy.

Recommendations Against

For approval of axicabtagene ciloleucel, NICE considered results of the ZUMA-1 trial, an on-going, phase I/II single-arm study with a primary outcome measure of overall response rate. Results indicated an overall response rate of 82% for patients treated with axicabtagene ciloleucel and at last data cut off 42% of patients were still responding.

However, “the committee noted that there is no evidence on the effectiveness of axicabtagene ciloleucel directly compared with that of salvage chemotherapy. The committee concluded that axicabtagene ciloleucel was clinically effective, but it agreed that the lack of comparative data made the assessment of comparative effectiveness more challenging.”

In addition, the calculated range of cost-effectiveness estimates was wide and all estimates were greater than £50,000 per quality-adjusted life year (QALY) gained, the threshold considered to be cost-effective use of NHS resources.

The evidence base for the use of tisagenlecleucel in adults with DLBCL is also small. Clinical evidence for tisagenlecleucel’s approval in the United States was based on a small observational study and on a single-arm, multicenter, phase II trial (JULIET). According to NICE, Novartis presented data from 111 patients from JULIET and 14 patients from the observational study. “At the December 2017 data-cut, the median follow-up in JULIET was short and the survival data were immature so there was uncertainty in the robustness of all survival data,” NICE wrote in its draft guidance. In addition, there is currently no evidence comparing tisagenlecleucel with salvage chemotherapy, the current standard of care.

Similar to axicabtagee ciloleucel, cost-effective estimates for tisagenlecleucel were greater than £40,000 per QALY gained and the most plausible incremental cost-effective ratio was likely to be much greater than £54,000 QALY gained after accounting for subsequent stem cell transplant.

Striking Deals

“NICE often rejects things and then a negotiation between the drug company and the NHS occurs,” Chopra explained. “In some cases, this results in the United Kingdom getting slightly preferential pricing.”

For example, prior to NICE rejecting tisagenlecleucel for adults with DLBCL, the agency struck a

Tisagenlecleucel costs around £282,000 per patient at its full price, but the negotiated price was not publicized.

Shortly after this negotiation, NHS England also struck a deal with Gilead to provide access to axicabtagene ciloleucel through its Cancer Drugs Fund. The confidential deal will provide axicabtagene ciloleucel at a discount of the £300,000 list price.

“Given the fact that there will be at least three companies in this game soon – Novartis, Gilead, and, in time, Juno – the competition continue to help to bring prices down,” Chopra said.

Newsletter

Stay up to date on recent advances in the multidisciplinary approach to cancer.