- ONCOLOGY Vol 36, Issue 12

- Volume 36

- Issue 12

- Pages: 704-705

2022: The Oncology Year in Review

Co-editor-in-Chief Howard S. Hochster, MD, reviews the major clinical and scientific developments of 2022 in the oncology space.

The year 2022 has been a promising one in terms of advancements in the oncology space. Multiple FDA approvals came through, providing additional treatment options across various cancer types. The past year’s growth will certainly help further propel treatment improvement in 2023. Here, we discuss some events of the past 12 months that will also impact our patients with cancer, moving forward.

1: Inflation Reduction Act of 2022.

This law will provide the most sweeping insurance reform since the Affordable Care Act, and it may actually help even more patients. The cost of oral oncolytics is now a staggering $20,000 to $30,000 per month, and insurance plans with 20% co-pays were never designed for this. Lifetime caps for insurance payments now viciously affect our survivors and these will be eliminated so patients will maintain coverage as they live longer.

Several additional provisions will definitely help our patients financially. Beginning in 2023, insulin and durable supplies will be capped at $35 per month for Medicare patients. In 2024, the “catastrophic phase” of drug costs will no longer require patient co-payments, and in 2025, the full cap on all drug payments will be $2500. Medicare “expansion” and affordable drug plans will continue to be offered through the marketplace and subsidies will continue through the end of 2025, saving approximately $800 per year for each patient enrolled in these Medicare plans.

2: Drug price controls.

As a result of the Inflation Reduction Act, Medicare will be able to negotiate drug prices for the first time ever, beginning in 2024. Rather than paying the price for a new drug, CMS will announce 10 drugs (selected from the most costly brand name drugs without competitors) for negotiation, with the negotiated prices starting in 2026. Fifteen more drugs will be negotiated in 2027, and from 2028 on, 20 drugs will be negotiated annually. For the first time, Americans will benefit from the same process used by many government health authorities around the globe, so that we will no longer carry more than our fair share of the costs of new drugs.

3: New drug approvals.

The FDA approved 7 new oncology drugs this year, most recently a novel antifolate receptor antibody-drug conjugate (ADC) for ovarian cancer, mirvetuximab soravtansine-gynx (Elahere). The others approved were tebentafusp-tebn (Kimmtrak), a bispecific gp100xCD3 antibody for uveal melanoma; relatlimab-rmbw (Opdualag), a fixed-dose combination of relatlimab, an LAG-3–blocking antibody, plus nivolumab (Opdivo) for melanoma; futibatinib (Lytgobi), an FGFR inhibitor for cholangiocarcinoma; tremelimumab (Imjudo) plus durvalumab (Imfinzi) for unresectable hepatocellular carcinoma; teclistamab-cqyv (Tecvayli), a bispecific B-cell maturation antigen (BCMA) CD3 antibody for use in fifth line or later relapsed/refractory multiple myeloma; and a second peptide radionuclide receptor therapy (PRRT) agent, lutetium Lu 177 vipivotide tetraxetan (Pluvicto), for prostate cancer.

4: Immunotherapy.

There was continued progress in the use of immune checkpoint inhibitors (ICIs), with new agents directed against LAG-3 and new indications for combined anti–CTLA-4 and anti–PD-1. In addition, the benefits of earlier use of anti–PD-1 for microsatellite instability–high tumors were shown for the first time in cases of colon and rectal cancer, perhaps eventually to supplant chemotherapy, radiation therapy, and surgery.

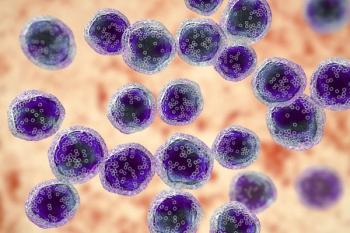

5: Cellular therapy.

Chimeric antigen receptor (CAR) T-cell therapies continued to expand their utility, with approvals for their use in extended relapsed and refractory follicular lymphoma. Lisocabtagene maraleucel (Breyanzi) was approved for second-line therapy in large cell lymphoma, and idecabtagene vicleucel (Abecma), directed against BCMA, was approved for refractory myeloma.

6: CRISPR entered the clinic.

This novel technology incorporates DNA guides based on bacterial “clustered regularly interspersed palindromic repeats,” and it can now be used for actual gene engineering in human patients. With the FDA approval of betibeglogene autotemcel (Zynteglo) in August, under the 21st Century Cures Act (specifically, the provisions for Regenerative Medicine Advanced Therapy), patients with transfusion-dependent double-mutated β-thalassemia, who cannot be treated with stem cell transplantation, can undergo CRISPR editing of their own stem cells to reinsert copies of normal β-hemoglobin genes. This one-time treatment will cost an estimated $1.8 million, but it is felt to be cost-effective, given the costs of frequent transfusions and treatments of iron overload syndromes.

7: Biosimilar approvals.

With 4 more biosimilars approved in 2022—pegfilgrastim, bevacizumab, an additional filgrastim, and ranibizumab, a VEGF product for ocular injection—the number of approved biosimilars has now reached 34. These continue to be identified by 4-letter suffixes to create “branded biosimilars.” These are not interchangeable or substitutable, causing chaos in our pharmacies and approval processes. We again call on the FDA to make these more like “generics” when prescribing, as there is no clinical basis for preferring one biosimilar over another at this time.

Looking ahead to 2023, what can we expect? To start, more immuno-oncology trials reading out, and further defining the use of current and new ICIs. We will also see novel ADCs, new PRRT agents, and continued advances in cellular therapies including CAR T, T-cell receptor-based therapy, and tumor-infiltrating lymphocytes. We can expect further gene engineering using CRISPR now that the barrier has been broken, with costs of up to $3 million per treatment. It promises to be an exciting year ahead. Happy New Year to all.

Articles in this issue

Newsletter

Stay up to date on recent advances in the multidisciplinary approach to cancer.