Oncology NEWS International

- Oncology NEWS International Vol 5 No 5

- Volume 5

- Issue 5

Health of Biotech Industry a Concern to Oncologists

BETHESDA, Md--Of the more than 1,300 biotech companies in North America, up to 70% are involved in health care, and many are working on cancer research, Frederick Craves, PhD, of Burrill & Craves, a merchant bank in San Francisco, said at a meeting of the National Cancer Advisory Board (NCAB).

BETHESDA, Md--Of the more than 1,300 biotech companies in NorthAmerica, up to 70% are involved in health care, and many are workingon cancer research, Frederick Craves, PhD, of Burrill & Craves,a merchant bank in San Francisco, said at a meeting of the NationalCancer Advisory Board (NCAB).

"Although the biotech industry is a young one," Dr.Craves said, "there are real products out there now beingsold for use in cancer."

A number of experts from the biotech industry, Wall Street, thelegal profession, and the NCI spoke to the NCAB about the roleof the biotech industry in cancer research and expressed someconcerns about the industry's financial health.

Dr. Alan Goldhammer, director of technical affairs, BiotechnologyIndustry Organization, Washington, DC, said that the cost to developnew drugs has increased over the rate of inflation, "andso we need to look at how the approval process can be improvedto speed up getting drugs developed and to market."

Fortunately, he said, FDA approval time has come down becauseof recent changes allowing companies to pay part of the costsfor FDA reviews. What remains to be done is the streamlining ofthe approval process for changes once the drug is being manufactured.

Brian M. Poissant, a senior partner at the law firm of Pennie& Edmonds, New York, said that obtaining patents for new cancerdrugs can be a tricky process for young biotech companies, andsometimes the secrecy required for patent approval can work againstcancer research.

Originally, only three things were required for a patent, he said:"The product had to be new; it had to be different; it hadto do what you said it did." But in 1990 the Patent Officechanged the rules for biotech products, requiring human clinicaldata showing treatment efficacy. This alone added 4 to 6 yearsto the patenting process.

While companies could file for the patent before showing proofof efficacy, they risked cutting short their real patent time(20 years from the date of filing), Mr. Poissant said. Those companiesthat delayed filing until the final stage of proof was reached,to increase their profits at the far end, risked having anothercompany file ahead of them.

The Patent Office recently abolished the human data requirementfor biotech patents, thus shortening the process. Mr. Poissantsaid that companies can file a provisional application to reservethe patent for their product yet keep the 20-year clock from starting.

Only 5 in 1,300 Profitable

Dennis J. Purcell, of Hambrecht & Quist, a Wall Street firm,said that the biotechnology industry went from being considereda bad stock risk in the 1980s and early 1990s to an enormouslyprofitable investment by late 1995.

Now, in 1996, investors have grown more cautious and generallywant phase III FDA approval of a company's product before investinglarge amounts. "Only five of the 1,300 North American biotechcompanies are currently profitable," Mr. Purcell said, "andstock can drop as much as 50% when phase III studies fail to showefficacy." On the other hand, he noted, the values went upsignificantly after certain companies showed good clinical results.

Mitchel Sayare, PhD, CEO of Immunogen, Cambridge, Mass, urgedcollaboration between academia and biotech companies. He explainedthat the entire world shops for biotechnology in the United Statesbecause "we are more entrepreneurial, we have more venturecapital, and we have available publicly funded, cutting edge researchbeing performed in the universities."

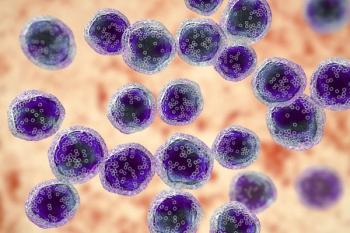

Immunogen has had a long-term relationship with the Dana-FarberCancer Institute, he said. Together they developed a monoclonalantibody-based product that involved almost $10 million in fundingover 10 years.

The relationship benefited Dana-Farber in the form of royalties,stock appreciation, funding of academic research, coverage ofpatent costs, and the patent itself.

Immunogen gained in ideas, knowledge, technology, basic researchcapabilities, clinical trials capabilities, and access to Dana-Farberstaff. Meanwhile, Dr. Sayare said, the taxpayer benefits fromthe innovation by possible reductions in health care costs andimprovements in quality of life.

Robert Wittes, MD, of the National Cancer Institute (NCI), saidthat the biotechnology industry exists only because of publicinvestments such as those from the NIH and NCI. "An amazingamount of discovery is going on in the biotech field," hesaid, "but the industry is much better at fundamental discoverythan at systematic preclinical and clinical development of newdrugs."

Thomas Mays, PhD, JD, director of technology development, NCI,said that, as a Federal agency, NCI can accept funds only underspecific authorities, such as royalties, and can spend such fundsonly in ways legislated by Congress.

"It is important that NCI utilize its financial resourceseffectively," Dr. Mays said. "Because of these limitations,it is crucial for NCI to attract good collaborators from the privatesector early in the research stage."

Articles in this issue

almost 30 years ago

No Need to Delay Mammography After FNA, Study Showsalmost 30 years ago

Pediatric Cancer Guidelines Are a National Effortalmost 30 years ago

EPA Proposes Changes in Determining Cancer Risk of Chemicals, Pollutantsalmost 30 years ago

ATL's HDI Digital Ultrasound Is Approved for Breast Indicationalmost 30 years ago

NIH Study Suggests That 200 mg Is The Optimal Daily Dose of Vitamin Calmost 30 years ago

Natural History of HIV Supports the Use Of Early Interventionsalmost 30 years ago

Aids Vaccine Trial Fails to Show Clinical Benefitalmost 30 years ago

Rep. Porter Honored For Work on BudgetNewsletter

Stay up to date on recent advances in the multidisciplinary approach to cancer.