- ONCOLOGY Vol 13 No 2

- Volume 13

- Issue 2

What BMT Nurses Should Know About Insurance Issues

Bone marrow transplantation (BMT) nurses need to educate themselves about their patients’ insurance coverage, said the Oncology Nursing Society (ONS) at its Eighth Annual Fall Institute. First, nurses must verify that patients have coverage and

Bone marrow transplantation (BMT) nurses need to educate themselves about their patients insurance coverage, said the Oncology Nursing Society (ONS) at its Eighth Annual Fall Institute. First, nurses must verify that patients have coverage and then determine in which of three probable ways the coverage handles transplants: (1) as medically necessary cancer therapyin which case, any burden of proof falls on the transplant team; (2) as excluded under the terms of the policythe policy states that it doesnt cover any transplants or it covers only certain types (eg, it covers leukemia but not breast cancer); or (3) as an experimental or investigational treatmentthe policy states that it will not cover experimental or investigational therapies or that it may cover only randomized National Cancer Institute (NCI) clinical trials.

In addition, some insurance companies have contract agreements with certain transplant centers called centers of excellence, the only facility where the transplant may be performed. To perform the transplant elsewhere requires evidence that the alternative transplant center has good outcomes and that the procedure can be done at a reasonable price.

Cost-containment measures that insurance companies have adopted include establishing reasonable and customary fees, inserting preexisting condition clauses into their policies, requiring preauthorization and often a second opinion, limiting coverage to a certain amount, or specifying exclusions for specific procedures in the policy itself or insisting that transplants be performed only in their own centers of excellence.

If Coverage Is Denied

Insurance companies will need the target date of the transplant, relevant patient information, and medical justification information from the transplant physician(s). The patients nurse should request written verification of coverage and payment, but if coverage is denied, there are other options. The denial can be negotiated diplomatically along these guidelines:

Cooperate with the payors in the insurance company. Dont be adversarial or insist that the insurer pay for the transplant; instead, focus on why the patients case is a good one.

Supply medical justification for the procedure.

Appeal quickly. Some insurance companies allow only 60 days between the denial and appeal.

Speak the insurers language and avoid words like experimental or investigational. These send up red flags.

Update protocols and patient consent forms. Always provide current information.

Write an effective appeal letter describing the patients current condition, history, and why coverage was initially denied.

Give a list of 5 to 10 physicians names as references, preferably prominent physicians who support the transplant for this particular patient.

Cite the transplant centers qualifications for the procedure.

If the insurance company still denies coverage, the patient or the transplant center can appeal to the patients employer to intervene. If that fails, litigation may be the next step. The threat of litigation has persuaded many insurance companies to cover a transplant, especially if there is evidence that its denial is dominated by the companys economic self-interest.

Alternative Funding Sources

If insurance coverage is denied despite these efforts, patients may obtain funding by establishing a nonprofit corporation to collect tax-deductible donations, holding auctions or other public events to raise money, or soliciting funds through the radio, newspaper, and other media.

Bone marrow transplantation is expensive. Compatibility testing for BMT costs about $5,000; bone marrow harvest, about $15,000; and the transplant itself, from $130,000 to $200,000.

The patients and familys lost income are additional costs that need to be calculated.

Since conventional treatment costs $15,000 to $40,000, there are increasing efforts throughout the country to ensure coverage for anyone who needs a transplant instead. The National Association of Insurance Commissioners is considering a model act for states that would set a minimum standard of coverage for BMT. Medicaid covers BMT in most cases for breast cancer; CHAMPUS, the military insurer, covers transplants for breast cancer if the person is enrolled in an NCI randomized clinical trial; and the Federal Employee Health Benefits Program (covering 9 million people in the United States) covers BMT for breast cancer.

Articles in this issue

about 27 years ago

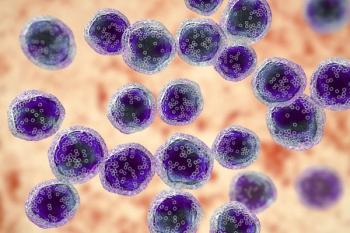

High-Dose Cytarabine Produces High Cure Rate in Some AML Patientsabout 27 years ago

A Primer on BMT for New Transplant Nursesabout 27 years ago

Fewer Complications With Modified Radical Surgery of the Vulvaabout 27 years ago

ONS Guidelines on Office-Based Clinical Trialsabout 27 years ago

New Web Site Fills Need for Reliable Cancer Informationabout 27 years ago

Fatigue Is Strongest Cancer-Related Side Effect, Survey Showsabout 27 years ago

Complementary Treatments Highlighted at Recent Meetingabout 27 years ago

Alternatives to Oral Opioids for Cancer Painabout 27 years ago

Alternatives to Oral Opioids for Cancer Painabout 27 years ago

Molecular Staging of Prostate Cancer: Dream or Reality?Newsletter

Stay up to date on recent advances in the multidisciplinary approach to cancer.